How does the UK government support EV fleets?

Did you know that the UK government offers a range of ways to help subsidise bringing electric vehicles into your fleet? Here, we break down the different types of support available – keep reading to find out how they can benefit you and your business.

What’s the OZEV?

The Office for Zero Emission Vehicles (OZEV) is part of the Department for Transport and the Department for Energy Security and Net Zero.

OZEV’s primary purpose is to support the transition to zero emission vehicles (ZEVs). It works across government and the wider vehicle industry and is closely involved with the British Vehicle Rental and Leasing Association (BVRLA) and other groups. OZEV also manages funding and grants for charge point infrastructure, which we’ll get into more later.

Are government grants available for EV purchase?

The government stopped issuing grants for purchasing electric cars in June 2022, but the good news is you can still get grants for electric vans and commercial vehicles like trucks. And this means qualifying vehicles can be sold with up to a £25,000 discount off the purchase price of a large truck, or £2,500 off a van. To be eligible, your van or truck must have CO₂ emissions of less than 50g/km and be able to travel at least 96km (60 miles) without any emissions.

It’s important to note that these grants are reviewed regularly, so if you have vans in your fleet, keep in mind that the rules may change at very short notice – don’t get caught out.

We’ve detailed the grant rules below to help:

Available Grants*

*Correct at the time of writing (September 2023)

In order to be eligible for the Grant, the vehicle must be delivered within a set period of time

-

Ordered on or before 31 March 2023: 18 months for order to be delivered (before 1 October 2024)

-

Ordered on or after 1 April 2023: 12 months for order to be delivered (before 1 April 2024)

Want to find out more? Head to our Tax Guide.

What about grants for charging points?

In terms of domestic charge points, the Electric Vehicle Homecharge Scheme pays up to 75% of the installation costs up to a maximum of £350. This is available to people who own or let a flat or residential property with either a private, off-street parking space or access to adequate on-street parking. You must use have an eligible leased vehicle/company car/owned vehicle (where you're the registered keeper).

E.ON offer for Alphabet customers

Together with E.ON, we’re offering customers support through exclusive home charging offers, from fully-fitted 7kW wallboxes, to flexible 50kW installations for convenient home charging. And through our partnership, E.ON will be on hand to guide you through the entire process, to keep things as simple as possible.

With over 5 million customers in the UK, E.ON Next is an experienced supplier and installer of EV charging solutions. From our seamless online portal, through to a virtual home survey and effortless installation, you can start your road to electric with Alphabet and E.ON in five simple steps:

You can learn more on the E.ON website or get in touch with your Alphabet representative for more information on the offer.

As for workplace charging, the government still provides grants of up to £350 for each workplace charging unit, up to a maximum of 40 per organisation. Until April 2025, a 100% first-year allowance is available to businesses for costs incurred on electric charge point equipment. Here’s a handy breakdown of the workplace schemes available:

Workplace Charging Scheme (up to £14,000 per company):

• Available to all qualifying businesses

• Up to £350 per socket

• Maximum of 40 sockets per company (across up to 40 sites)

EV infrastructure grant for staff and fleets (up to £75,000 per company):

• Available to businesses with fewer than 250 employees

• Up to £350 per socket (or £500 per parking space enabled with supporting infrastructure)

• Maximum of £15,000 per grant/site for up to 5 sites

Are capital allowances available for EVs?

Simply put, capital allowances are claims you can make on vehicles in your fleet, in which you can deduct part of the value from your profits before you pay tax.

Up until April 2025, any new and unused car with zero CO₂ emissions entering your fleet will qualify for a 100% first-year allowance. Any second-hand EVs – or EVs with CO₂ emissions of 50g/km or less – will qualify for an 18% ‘main pool’ allowance, unless you claim an Annual Investment Enhanced Capital Allowance. If you want more help understanding this, get in touch and we’ll be more than happy to talk it through with you.

What’s the Vehicle Excise Duty for EVs?

Vehicle Excise Duty (VED) – commonly known as road tax – is a tax levied on every vehicle using public roads in the UK. It’s collected by the Driver and Vehicle Licensing Agency (DVLA).

For most cars registered before April 2017, the amount of VED due depended primarily on the car’s official CO₂ emissions. For cars registered from April 2017 onwards, first-year VED payments are related to CO₂ emissions, but subsequent payments are not.

It’s worth noting that first-year VED of Ultra Low Emission Vehicles (ULEVs) is considerably lower than many petrol and diesel vehicles. EVs and zero emission vehicles will start paying VED from April 2025 – only those registered after 1 April 2025 will also pay the expensive car supplement.

What’s the Benefit-in-Kind for EVs?

Benefit-in-Kind (BIK) is the tax paid on benefits that employees receive from their company which aren't included in their salary or wages. This includes company cars.

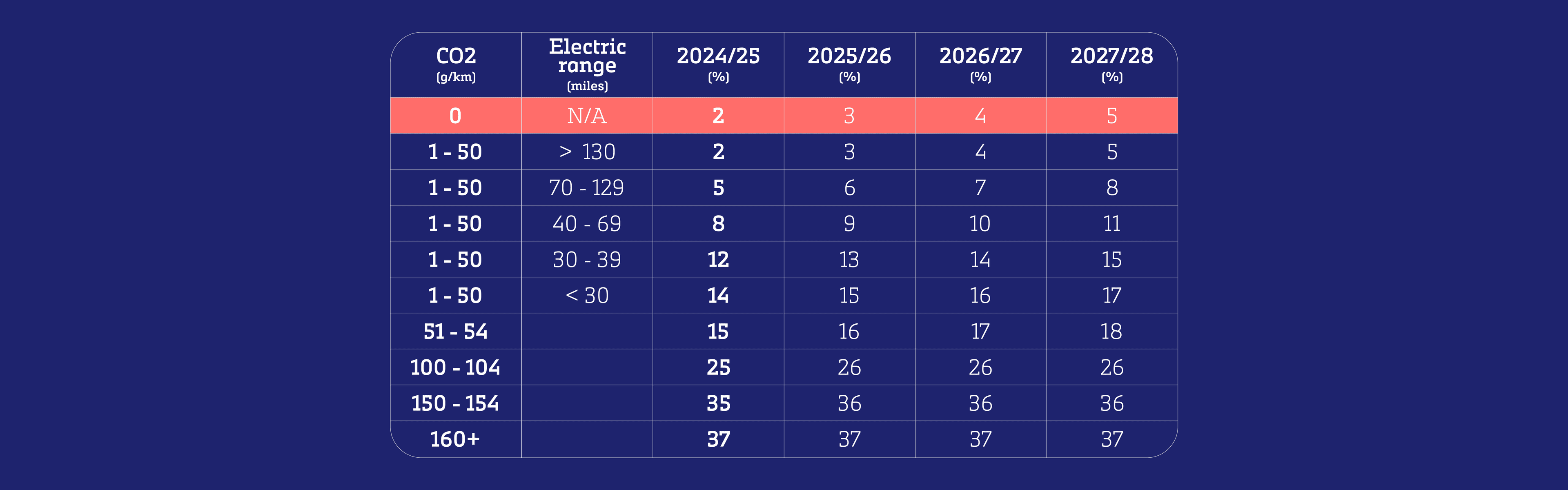

The amount of BIK tax employees pay for a company car depends on how much CO₂ the vehicle emits. For EVs, this amount is very low at just 2%, rising to 3% for the tax year 2025/26. This is good news for both you and your drivers – switching from a petrol or diesel vehicle can help your drivers save big, and it can also lower Class 1A National Insurance Contributions (NIC) costs for you, the employer. Review our comparison chart below to see how BIK tax depends on emissions.

There’s also Van Benefit Tax (VBT). A nil rate of tax currently applies to zero-emissions vans within Van Benefit Charge, which means that you could allow your electric van drivers unrestricted private use of their van as a tax-free employee benefit.

Want to compare the tax on different vehicles? Give our handy BIK calculator a try. Or, watch our video here in which our expert Ashley Banister takes you through how salary sacrifice can be used alongside BIK tax to increase employee savings.

How does the government support EV charging infrastructure?

The government provides funding to the Local Electric Vehicle Infrastructure (LEVI) pilot, which boosts the existing On-Street Residential Charge Point Scheme (ORCS). This helps councils work with charge point operators to improve the rollout of local charging infrastructure – especially for residents who don’t have off-street parking.

But this funding does more than just pay for charge points. It also helps local authorities to scale up their charging strategy plans by hiring more staff and investing in training. All of this helps drive forward the decarbonisation of the UK’s transport system.